Today marks the day as the program celebrates its 80th anniversary, but will it still be there in the future? On August 14, 1935, President Franklin D. Roosevelt (FDR) signed the Social Security Act into law with these profound words: “Today, a hope of many years standing is in large part fulfilled…We have tried to frame a law which will give some measure of protection to the average citizen and to help families against the loss of a job and against poverty-ridden old age.”

Today marks the day as the program celebrates its 80th anniversary, but will it still be there in the future? On August 14, 1935, President Franklin D. Roosevelt (FDR) signed the Social Security Act into law with these profound words: “Today, a hope of many years standing is in large part fulfilled…We have tried to frame a law which will give some measure of protection to the average citizen and to help families against the loss of a job and against poverty-ridden old age.”

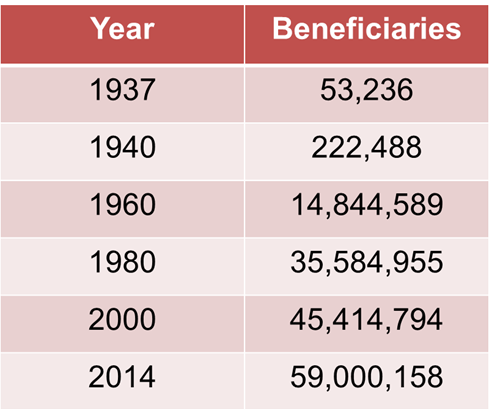

Social Security Income (SSI) is not just for retirees, but for children, spouses, people with disabilities, and survivors across the country. It is truly a family program. The program started with only 53,000 beneficiaries in 1937, but has grown to 59 million beneficiaries as of 2014. SSI is the nation’s most effective anti-poverty program, keeping more than 20 million Americans out of poverty each year. On a personal level, at one point SSI helped my family. When I was 16 years old, my dad unexpectedly and suddenly passed from lung cancer leaving my mother as the sole financial provider. Social Security allowed us to receive survivor benefits since my mother was now a widow and for me as his child. Those benefits were extremely helpful in supplementing the household income. SSI helped keep food on the table, the household bills paid, provided school clothes, and helped pay for college application fees.

Ok, but will Social Security still be there in the future? Social Security has never failed to deliver monthly benefits in full and on time since benefits were first paid in 1940. Social Security trustees continually monitor the system’s finances and annually project it’s income and outgo over the short term (10 years) and long term (75 years). In the short term, Social Security is fully financed. Workers pay 6.2% of their earnings for Social Security, up to cap ($117,000 in 2014) & employers pay a matching amount. In the long term (75 year projection period), it faces a manageable shortfall. If no action is taken before 2033, Social Security will be only able to pay about 77% of the scheduled benefits thereafter. This shortfall need NOT occur!! Policymakers have many options to increase the system’s income, reduce future benefits, or both, to close the projected shortfall & ensure that all scheduled benefits will be paid for into the future. Since Social Security began in 1935, Congress has amended the program many times to meet new needs & ensure that promised benefits will be paid. Lawmakers understand that millions of Americans & their families are counting on Social Security to be there for them.

A recent survey by the National Academy of Social Insurance (NASI) found that 8 in 10 Americans agree that it is important to preserve Social Security for future generations even if it means increasing what working Americans pay into Social Security. Agreement is strong across generations and income levels and among Republicans, Democrats, & independents. Surveys confirm that Americans of all generations value Social Security & are willing to pay to keep it strong!

To celebrate and learn about how Social Security can help you and/or your loved ones, please check out the link: www.ssa.gov. Commissioner of the Social Security Administration, Carolyn W. Colvin, Social Security employees, stakeholders and many others are thrilled to celebrate Social Security’s 80th anniversary!! Are you? http://www.ssa.gov/80thanniversary/

Resources: National Academy of Social Insurance, Social Security Adminsitration, National Urban League- Washington Bureau

Leave A Comment